ICA and ICCM Advanced Certification in Governance,Risk and Compliance(English Version)

【Course Details】

As the world of compliance changes at an ever-increasing pace:

•This course gives you the specialist knowledge and practical skills to manage regulatory risk both now and in the future.

•You will gain an improved understanding of how excellent compliance management protects your firm, as well as enhances its competitive advantage, including how to maximise the use of new technology.

•This course is awarded by the International Compliance Association and ARPA.

•What do we need to understand about regulation?

•Understanding governance, risk and compliance (GRC)

•Practical GRC

•Managing compliance and regulatory risks

•Core GRC topics: financial crime, ESG, conduct risk, data

【Is this course right for me?】

This course is suitable for anyone who is interested in pursuing a career in the discipline.

However, the content of the programme requires students to possess:

•Sound educational background

•Good written English skills

This course is suitable for:

•Compliance employees or employees who have recently been given or aspire to be given compliance responsibilities or those employees with management responsibility for compliance employees

•Any person who wishes to acquire an understanding of fundamental regulatory compliance principles and how businesses can comply with them

•Lawyers

•Company secretaries

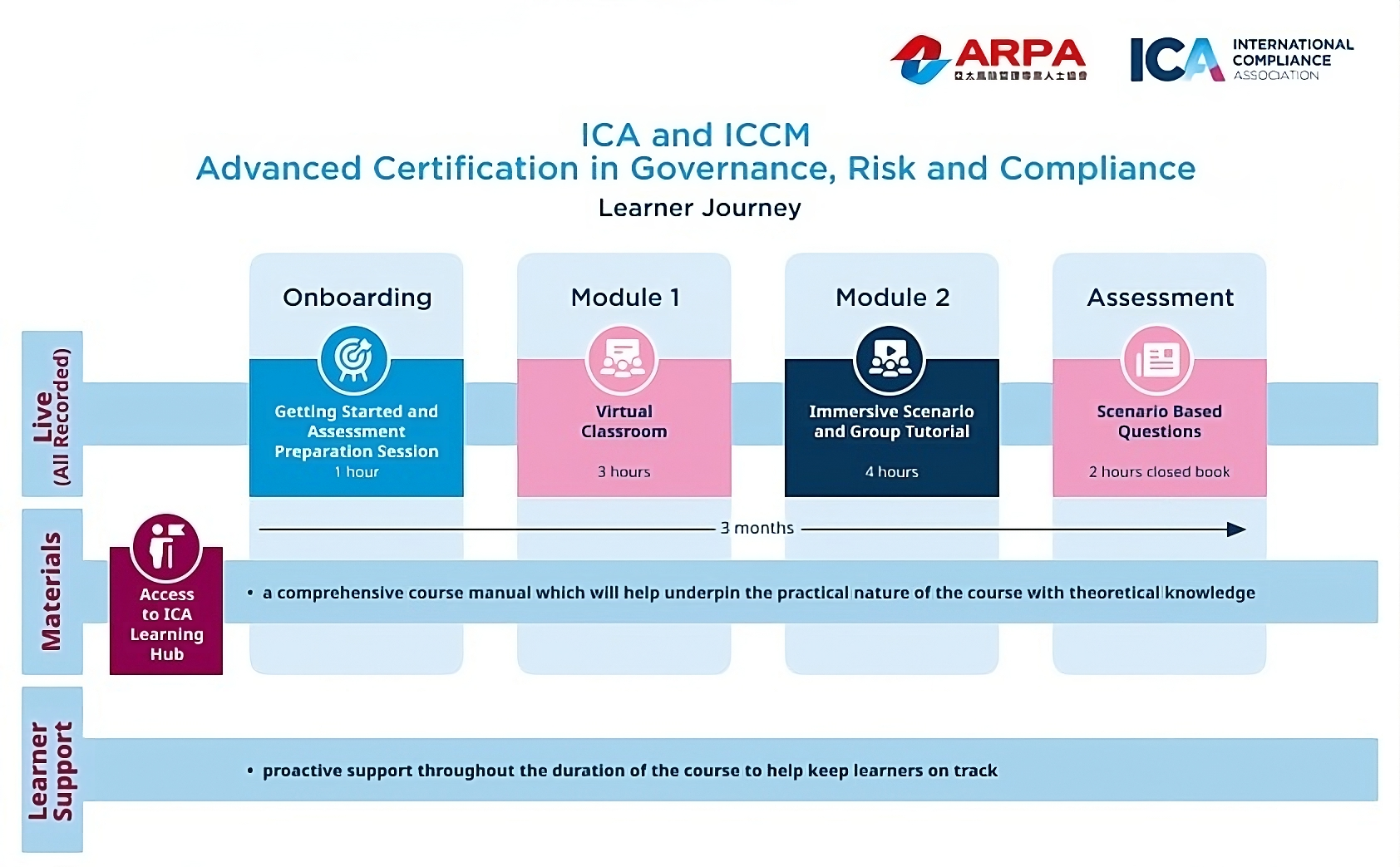

Online Blended Learning

A flexible, part-time format design for busy, working professionals. A mix of guided, online study and attendance at live, virtual classrooms delivered by ICA’s expert faculty.

【Sample Certificate】

【Fees and Payment】

•Standard Rate: USD 2,000 (including fees of registration, examination, Training and Certification and related taxes)

•Payment Method (Bank Transfer):

A/C name:HONG KONG SAGE EDUCATION CO., LIMITED

A/C no:848870721838

Bank Name:The Hongkong and Shanghai Banking Corporation Limited

Swift Code:HSBCHKHHHKH

Bank Address :1 Queen's Road Central, Hong Kong

【Contact Info】

For Enrollment: enroll@arpa-global.org

Download Enrollment Form: Please Click Here

|

|

|

|

|